Market Insight Series - October 2022

- Oct 6, 2022

- 4 min read

What does the current Victoria real estate market look like?

As part of our monthly Market Insight Series, I am excited to continue to bring you regular insights into the Victoria and Vancouver Island market trends, so you can make better buying and selling decisions. Below I will jump into the most important market numbers to look into, I will provide glossary term definitions, and will conclude with resources if you want to further research current trends and stats. If you want to see what the Market Insight for the previous month was, click here.

*Our mortgage rates have been broadened by adding smaller lenders in addition to the major Canadian banks

There were 410 properties sold in Victoria last month, 46.1 percent lower than the 761 properties sold in September 2021. As with most of this year, this is a continued trend that can be expected to persist at least until Spring or Summer of next year.

As previously discussed, this is largely driven by rising interest rates which have been making property purchases less appealing for buyers and no longer obtainable for many first time buyers who were previously prequalified at a lower mortgage rate. In Canada, home buyers need to qualify to not only afford the rate they are approved for, but also a higher stress test rate that is implemented to protect home buyers from future market shifts. The current stress test rate is the greater of 5.25 percent or 200 basis points (2 percent) above the qualifying rate for an uninsured mortgage*.

*Uninsured mortgages are those mortgages where the buyer has 20% down and doesn't require mortgage insurance. Alternatively the qualifying rate for insured mortgages (those with less than 20% down) is either the greater of the insured minimum qualifying rate or the customer's mortgage interest rate plus 200 basis points (2 percent).

Whether insured or uninsured, the continued mortgage rate hikes are pushing many first home buyers out of the market who are no longer able to qualify for a mortgage. If a first time buyer is seeking a fixed mortgage rate at 4.59% then the stress test could mean they need to qualify for a mortgage rate of 6.59%. The result is that many potential buyers are being pushed out of the market, and many qualified buyers are staying out of the market which is dampening demand. Looking forward, many buyers are waiting for interest rate hikes to end and economists anticipate that we could see another 50 basis point (0.5%) hike this month, followed by an additional 25 basis point (0.25%) increase in December. This would result in a 4% policy rate for the Bank of Canada motivating lenders to push mortgage rates even higher.

The summation of declining demand and increasing inventory is moving us toward a buyers' market. Although the absorption rate currently sits at 21% indicating that we are somewhere between a seller's market and a balanced market, actual market behaviour indicates we may already be in a buyers' market. In Victoria we are seeing declining real estate prices, listings that are sitting for weeks and sometimes months, and buyers able to negotiate on both conditions and price.

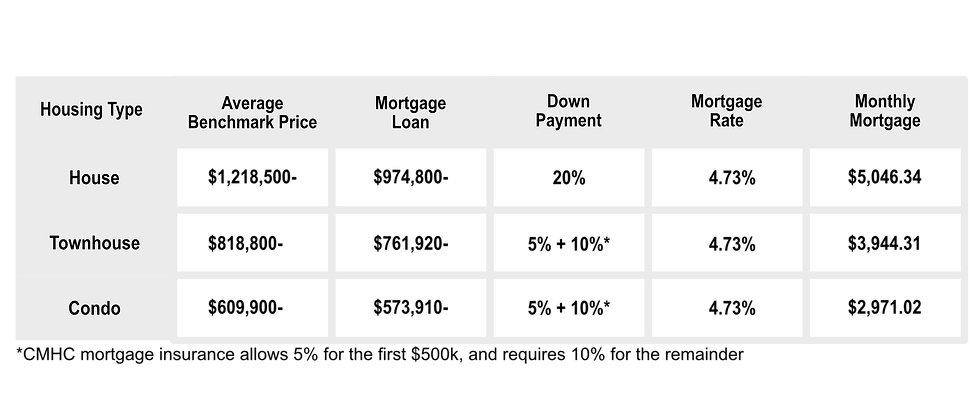

Below is a table that outlines the current housing benchmark pricing along with a sample calculation that can give you an idea of what it might cost you to own a home.

At this time it seems like there is real opportunity for any buyer who is hoping to purchase within the next 6 months. Approached carefully, it's possible for a buyer to find, purchase, and move into a home today at a negotiated price that could match or even beat out what they might get by waiting until the Spring or Summer market. This is because there is uncertainty in the market about when interest rate increases will stall and eventually reverse. This uncertainty creates opportunity for buyers who are able to negotiate with the goal of paying tomorrow's lower prices today. However, this window of opportunity will start to close when interest rate increases stop, causing many buyers to jump back into the market and setting the stage for the next leg up in the Victoria real estate market.

Opportunities for ordinary people looking to get into their first home, or move up into one of the more affordable homes that are in and around the $1M or less range are still out there, it just takes a bit more diligence, and ideally the support of a committed agent.

Conclusion

The goal is to give you insight into what the overall market view looks like in Victoria and Vancouver Island. I have included more Resources below so that you can dive in and read more at your leisure. I will also make sure to include a new Glossary Term each month, and define it to add to your knowledge of common industry terms.

Feel free to contact me if you want to learn more or if you have any questions about the broader market trends.

Glossary Term

Real Estate Listing

An agreement that represents the right of a real estate agent or Broker to handle the sale of real property and to receive a fee or commission for services. In B.C., the two most common types of listing contracts are: The Exclusive Listing; and The Multiple Listing. Each type of listing lasts only for the time period which is specified in the agreement. Be sure to take note of what this time period is.

Resources

1. VREB Insight:

2. Mortgage Calculator:

3. Mortgage Rate By Bank:

Comments